Cooked Food Gst Rate . this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. learn about gst rates on food items and restaurants in india. Explore how 5%, 12%, and 18% gst apply to various. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. gst on food and restaurants. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. miscellaneous edible preparations.

from www.scribd.com

miscellaneous edible preparations. Explore how 5%, 12%, and 18% gst apply to various. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. learn about gst rates on food items and restaurants in india. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. gst on food and restaurants. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type.

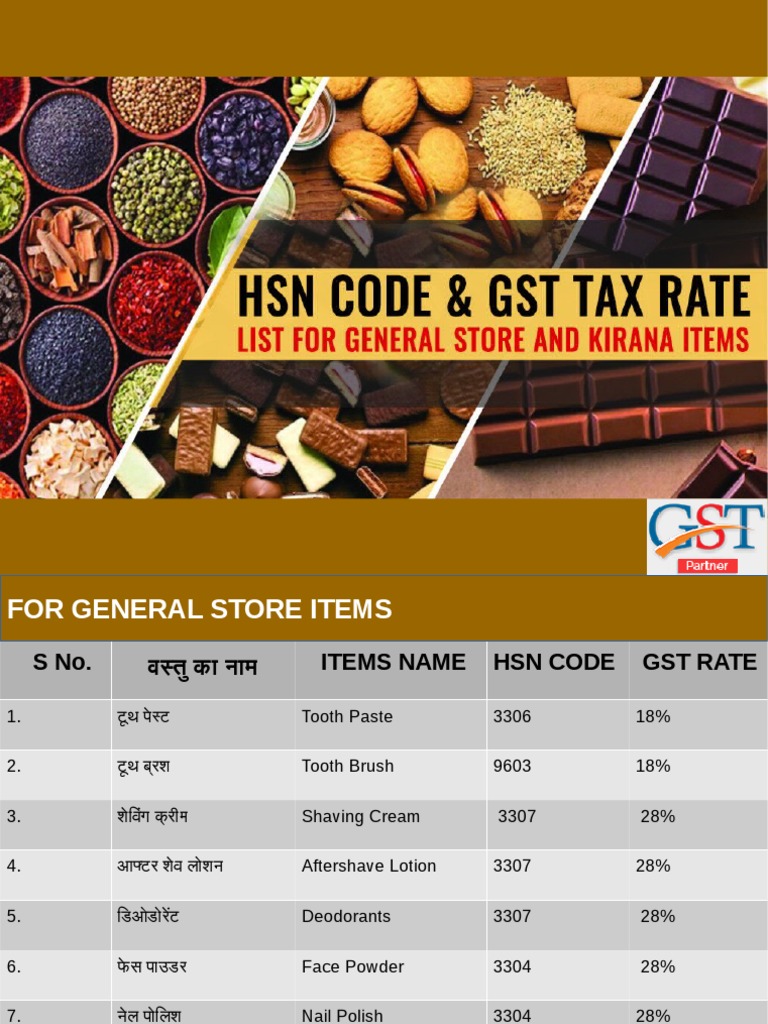

HSN Code & GST Tax Rate List for General Store and Kirana Items

Cooked Food Gst Rate under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. Explore how 5%, 12%, and 18% gst apply to various. learn about gst rates on food items and restaurants in india. miscellaneous edible preparations. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. gst on food and restaurants. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no.

From blog.saginfotech.com

Can One GST Rate Make Product Classification Easier, Check Cooked Food Gst Rate Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. miscellaneous edible preparations. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. of cooking and supply of food, by cloud kitchens/central kitchens are covered. Cooked Food Gst Rate.

From www.pinterest.com

n3338062005 GST food guide.indd GST Food Guide.pdf (BEST GUIDE FOR Cooked Food Gst Rate of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. miscellaneous edible preparations. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. learn about gst rates on food items and restaurants in india.. Cooked Food Gst Rate.

From khatabook.com

GST Rates & HSN Codes on Flours, Meals, Pellets & Oil Cakes Chapter 23 Cooked Food Gst Rate birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. Explore how 5%, 12%, and 18% gst apply to various. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. Gst on food items in india can be. Cooked Food Gst Rate.

From timesofindia.indiatimes.com

New GST rates come into effect Daily use products, eating out get Cooked Food Gst Rate of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. gst on food and restaurants. this article explains the impact of gst on the restaurant and food. Cooked Food Gst Rate.

From www.scribd.com

gst rates Foods Food & Wine Cooked Food Gst Rate Explore how 5%, 12%, and 18% gst apply to various. miscellaneous edible preparations. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. learn about. Cooked Food Gst Rate.

From www.indiatoday.in

GST rate hikes List of goods and services which are expensive now Cooked Food Gst Rate Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. gst on food and restaurants. learn about gst rates on food items and restaurants in india. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or. Cooked Food Gst Rate.

From www.youtube.com

how to calculate gst amount from total amount in excel YouTube Cooked Food Gst Rate this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. learn about gst rates on food items and restaurants in india. Explore how 5%, 12%, and 18%. Cooked Food Gst Rate.

From www.captainbiz.com

GST Rate on Dry Fruits and HSN Code for Cashew, Fruits etc. Cooked Food Gst Rate Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. learn about gst rates on food items and restaurants in india. miscellaneous edible preparations. gst on food and restaurants. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on. Cooked Food Gst Rate.

From theviralnewslive.com

GST rate hike GST on food items, know how much the price has increased Cooked Food Gst Rate Explore how 5%, 12%, and 18% gst apply to various. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. this article explains the impact of. Cooked Food Gst Rate.

From www.deskera.com

GST on Food Services & Restaurant Business Cooked Food Gst Rate learn about gst rates on food items and restaurants in india. gst on food and restaurants. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. miscellaneous edible preparations. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in. Cooked Food Gst Rate.

From www.mudranidhi.com

GST Rates 2024 List of Goods and Service Tax Rates Slabs Cooked Food Gst Rate miscellaneous edible preparations. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked. Cooked Food Gst Rate.

From www.apnaplan.com

GST On Restaurants Cooked Food Gst Rate of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Explore how 5%, 12%, and 18% gst apply to various. miscellaneous edible preparations. gst on food and restaurants. learn about gst rates on food items and restaurants in india. under gst, restaurants are subject to. Cooked Food Gst Rate.

From blog.saginfotech.com

New List of GST Rates & HSN Codes on All Stationery Items Cooked Food Gst Rate Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. Explore how 5%, 12%, and 18% gst apply to various. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. this article explains the impact of. Cooked Food Gst Rate.

From enterslice.com

Animal Vegetable Fertilisers GST Rates & HSN Code 3101 Enterslice Cooked Food Gst Rate birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. Explore how 5%, 12%, and 18% gst apply to various. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. learn about gst rates on food items. Cooked Food Gst Rate.

From loanstreet.com.my

GST In Malaysia Explained Cooked Food Gst Rate miscellaneous edible preparations. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. Explore how 5%, 12%, and 18% gst apply to various.. Cooked Food Gst Rate.

From www.scribd.com

HSN Codes & GST Rates PDF Books Cooked Food Gst Rate learn about gst rates on food items and restaurants in india. gst on food and restaurants. birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise. Explore how 5%, 12%, and 18% gst apply to various. miscellaneous edible preparations. under gst, restaurants are. Cooked Food Gst Rate.

From razorpay.com

A Complete Guide to GST (Goods & Service Tax) RazorpayX Cooked Food Gst Rate miscellaneous edible preparations. learn about gst rates on food items and restaurants in india. this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. under gst, restaurants are subject to either a 5% gst rate without the option to claim input tax credit (itc) or an. Explore how. Cooked Food Gst Rate.

From learn.razorpay.in

GST Rates in 2023 List of Goods & Service Tax Rates Slabs Cooked Food Gst Rate this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. learn about gst rates on food items and restaurants in india. Explore how 5%, 12%, and 18% gst apply to various. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment. Cooked Food Gst Rate.